unemployment tax credit refund 2021

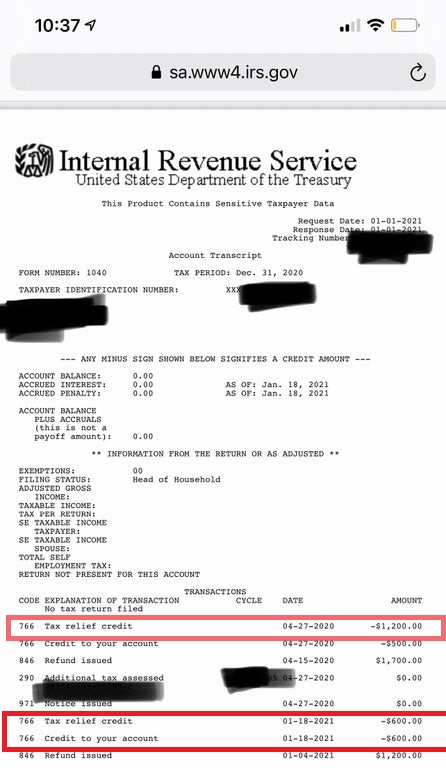

I have reviewed my 2020 and 2021 irs transcripts and found no indication that they have reviewed it for my refund. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax.

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. Child tax credit round three coming wednesday each child under six at the end of the year could be eligible for up to 3600 and those six through 17 at the end of 2021 could be eligible for up.

The American Rescue Plan Act of 2021 ARPA removed the subsidy cliff for 2021 and 2022 and allowed income earners above the 400 FPL to qualify for some subsidy assistance. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. Tax help 2021.

The American Rescue Plan Act had waived federal tax on up to 10200 of benefits collected in 2020. Dont expect a refund for unemployment benefits. Some 2020 unemployment tax refunds delayed until 2022 irs.

More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The IRS has already sent out 87 million.

Kentucky employers are eligible to claim the full FUTA credit of 540 when filing your 2020 IRS 940 forms in January 2021. The unemployment exclusion was enacted as part of the American Rescue Plan Act PL. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Saturday May 14 2022.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. American Rescue Plan Act Of 2021 Nontaxable Unemployment.

President Joe Biden signed the pandemic relief law in March. The internal revenue service says its not done issuing refunds for tax paid on covid unemployment benefits. Taxpayers must reply to the notices to receive the credit or credits although the notice is not confirmation they are eligible for them but do not have to file an amended return.

Households who are waiting for unemployment tax refunds can check the status of the payment Credit. The answer from the IRS is that unless the taxpayer is entitled to a credit or deduction they didnt claim on the 2020 tax return theyve already filed theres. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

IR-2021-212 November 1 2021. The IRS has identified 16. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

The American Rescue Plan Act of 2021 enacted on March 11 2021 suspended the requirement to repay excess advance payments of the premium tax credit excess APTC for tax year 2020. The American Rescue Plan exempted 2020 unemployment benefits from taxes. This tax break was applicable.

TAS Tax Tip. Quickly find new refund amount with 10200 unemployment deduction using tax software If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon. Unemployment tax credit refund 2021.

Tax refund unemployment 2021 1234M views Discover short videos related to tax refund unemployment 2021 on TikTok. Mr Nelzoncredittaxstrategisnelz Kim CPAkim_cpa The News Girl lisaremillard Carrie Petty Turnagecarrieturnage Virtual Tax Provirtualtaxpro. Meanwhile so far theres no indication that unemployment benefits received in 2021 will qualify for a tax break.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

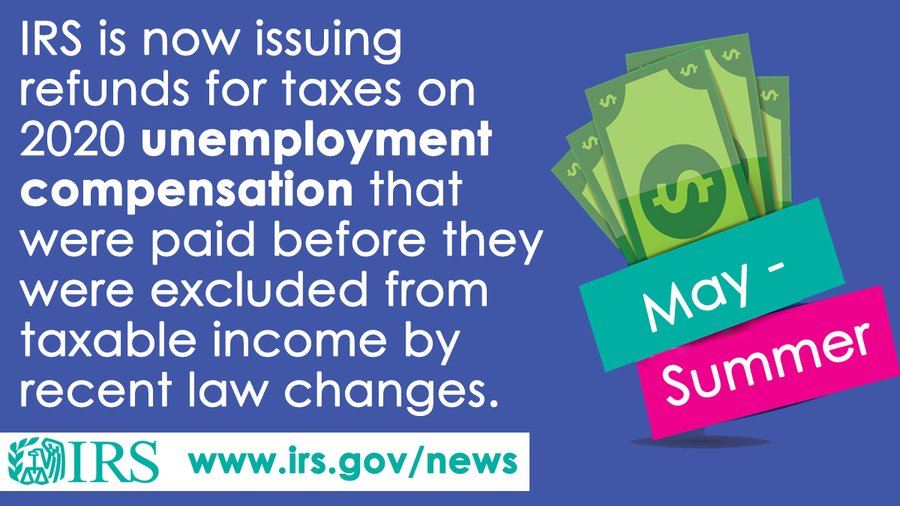

The federal tax code counts jobless benefits as taxable income. IR-2021-159 July 28 2021. T he Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15 million refunds sent out adding to almost nine million.

The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144 billion for tax year 2020. Getty What are the unemployment tax refunds. Some 2020 unemployment tax refunds delayed until 2022 irs.

Watch popular content from the following creators. 117-2 on March 11 2021 with respect to the 2020 tax year. In order to have qualified for the.

The exemption which applied to federal taxes meant that unemployment checks. The IRS has identified 16. The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns.

That provision didnt apply to 2021 benefits so you may receive a tax bill for your jobless benefits last year. 1222 PM on Nov 12 2021 CST. Some tax credits are refundable meaning that if the amount of your credit is more than the amount of your taxes due you will receive the difference back from the government in the form of a refund.

Congress hasnt passed a law offering. Unemployment Tax Refund Still Missing You Can Do A. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414.

While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The IRS efforts to correct unemployment compensation overpayments will help most of the affected.

Unemployment and Premium Tax Credit for 2021.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Tax Transcript Aving To Invest

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Confused About Unemployment Tax Refund Question In Comments R Irs

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irs Has 1 3 Billion In Refunds For People Who Haven T Filed A 2017 Return The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

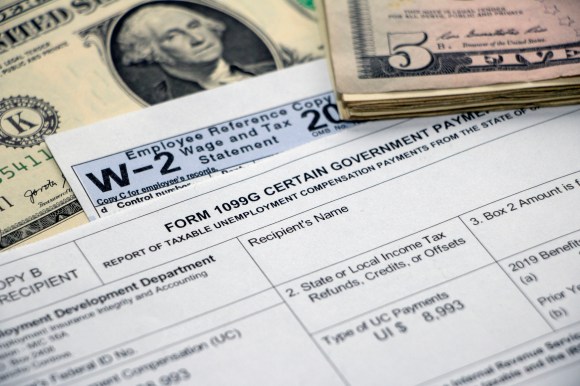

1099 G Unemployment Compensation 1099g

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year